There is a weird phenomenon that has cropped up in the options markets over the past couple of years. Even weirder is that this weird new phenomenon is flipping itself around.

The CBOE Put/Call Volume Ratio compares the numbers of put options and call options traded each day. A high reading means that comparatively more puts are getting traded, as options traders are convinced that prices are going to go down. Usually, a high Put/Call Ratio reading is a sign of a short-term bottom, because it means that traders have turned pessimistic.

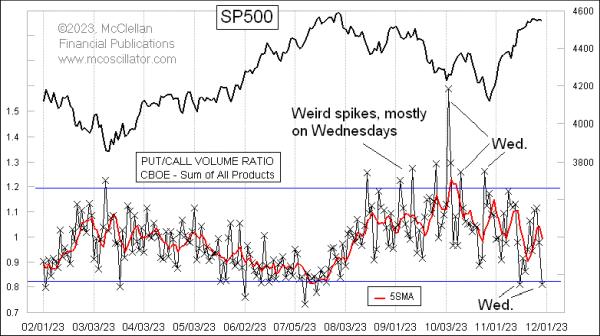

However, starting in 2022, there was a weird phenomenon in which the Put/Call Volume Ratio would spike on Wednesdays, and not in any relationship to what prices were doing. And it has happened again in September and October 2023 with these weird Wednesday spikes. I have not seen a good explanation for why this has been happening.

The weirder development is that the Wednesday high Put/Call spikes have now flipped to low readings. The high readings we were seeing in September and October happened as the S&P 500 was trending downward, and options traders were employing sophisticated strategies, selling puts as part of that downtrend. But now they are doing the opposite, emphasizing call trading on Wednesdays in a price uptrend.

We saw this same phenomenon of Put/Call Ratio spikes in 2022, first during the big market down wave in April to June 2022, and again late in the year.

When the S&P 500 returned to an uptrending mode in early 2023, the weird Wednesday phenomenon stopped.

I wish that this phenomenon offered us some great edge on how to make money trading, but sadly it does not. That said, it is still worth knowing about, so that we can keep ourselves from misinterpreting a big single day’s Put/Call reading — especially on Wednesdays. Knowing why something is happening is not nearly as important as knowing that it is happening, so that one does not inadvertently draw erroneous conclusions from seeing it.