President Donald Trump’s new round of tariffs —this time targeting copper— has intensified concerns about rising costs across key sectors, including healthcare.

But despite significant price pressures on steel, aluminum, and now copper, all vital to medical device production, there is no indication that US hospitals are stockpiling equipment ahead of expected price hikes, according to recent findings from GlobalData.

Announced earlier this week, Trump’s 50 percent tariff on copper imports matches the doubled rates already in effect for steel and aluminum.

The White House has defended these actions, imposed under Section 232 of the Trade Expansion Act of 1962, as necessary to protect US national security and revive domestic manufacturing.

But with tariffs applied indiscriminately across all import sources —excluding only the United Kingdom on certain metals—concerns are mounting over the downstream impact, especially on industries reliant on foreign raw materials.

“Although these tariffs are likely to impact distribution and increase consumer costs, some facilities may not have the financial resources to buy devices in advance,” said Amy Paterson, a medical analyst at GlobalData.

“While some markets have seen an increase in spending, it does not appear that healthcare facilities have been stocking up on medical devices in preparation for potential price increases or supply chain disruptions.”

Steel and aluminum are critical materials in the production of surgical tools, implants, diagnostic machines, and hospital infrastructure. Copper, now under the same elevated tariff level, is widely used in imaging equipment, monitors, and wiring for medical devices. All told, the latest tariff decisions mean higher input costs across a range of essential equipment.

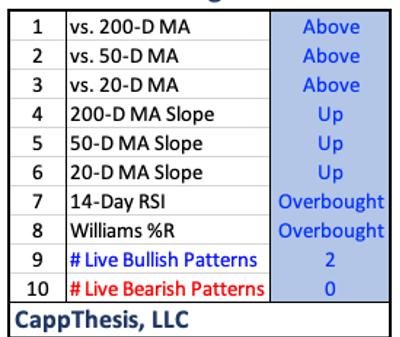

GlobalData’s US Healthcare Facility Invoicing Database, which tracks procurement activity across 56 medical device categories, shows no significant increase in healthcare spending between January and May 2025.

Even as May and June data continue to roll in, early signs suggest healthcare purchasing behavior remains steady, not preemptive.

This spending inertia comes despite broader signals that cost pressures on US healthcare providers may worsen. Unlike certain exemptions applied to pharmaceuticals or food products, the latest tariffs make no carveouts for medical equipment or life-saving devices.

This means that hospitals, who are already facing tight budgets and post-pandemic financial strain, may have to absorb higher equipment costs or pass them on to patients.

Taken together, the policy shifts and trade actions illustrate a broader Trump administration approach centered on cutting international dependencies, regardless of sector.

In metals, the administration argues, cheap imports from China and elsewhere have flooded global markets, putting US producers out of business and threatening industrial self-sufficiency.

The move to double tariffs on steel and aluminum reflects that ambition. Copper, added to the list this week, signals a continued hardline stance that could affect everything from defense manufacturing to consumer electronics.

The US imports more than half its aluminum and about one-third of its copper, much of it from countries like Canada and Chile.

By raising costs on these materials, the administration hopes to encourage domestic mining and refining. However, in the short term, US industries are bearing the brunt.

Securities Disclosure: I, Giann Liguid, hold no direct investment interest in any company mentioned in this article.