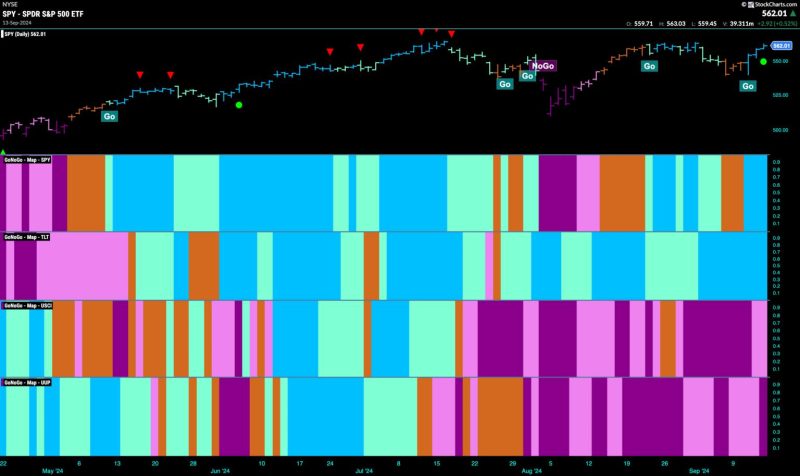

Good morning and welcome to this week’s Flight Path. Equities saw the “Go” trend return after a triplet of uncertain “Go Fish” bars. We saw blue “Go” bars from Wednesday on. Treasury bond prices remained in a strong “Go” trend painting blue bars the entire week. U.S. commodities remained in a “NoGo” trend this week but as the week came to a close we saw a couple of weaker pink bars. The dollar also saw its “NoGo” trend continue and after a string of weaker pink bars, we saw a strong purple “NoGo” bar to end the week.

$SPY Recovers From Uncertainty

The GoNoGo chart below shows that after several amber “Go Fish” bars representing uncertainty the “Go” trend found its feet again this past week. Strong blue “Go” bars returned on Wednesday and we saw prices climb close to prior highs once again. If we turn our attention to the oscillator panel we can see that the oscillator broke through the zero line into positive territory after having spent a few days below that level. Now, with momentum resurgent in the direction of the “Go” trend, we see a Go Trend Continuation Icon (green circle) under the price bar. We will watch to see if this gives price the push it needs to make a new higher high.

The longer time frame chart shows a strong recovery last week. Price made up all of the lost ground and closed near the very top of the week’s trading range. Now, with another strong blue “Go” bar and momentum in positive territory but not yet overbought, we will watch to see if price can climb further from here.

“NoGo” Trend Continues in Force for Treasury Rates

Treasury bond yields painted strong purple “NoGo” bars again this week and we saw a new lower low as the August low provided little support. GoNoGo Oscillator in the lower panel was rallying toward the zero line but has turned around and is falling once again toward oversold territory. Momentum is well and truly on the side of falling prices.

The Dollar’s “NoGo” Trend Survives Another Week

A strong purple “NoGo” bar returned at the end of the week after 4 straight weaker pink bars. Price failed to make a new higher high and rolled over mid week. Now, with a strong purple bar, we will look to see if price falls further. GoNoGo Oscillator is out of step with the trend which is interesting. Having broken out of a Max GoNoGo Squeeze into positive territory GoNoGo Oscillator is now at a value of 1. We will watch to see if this halts price’s move lower.